|

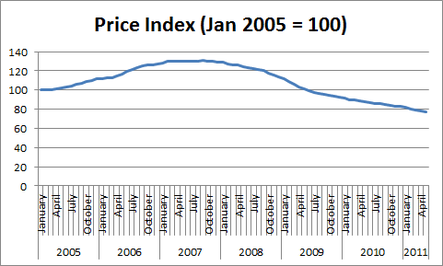

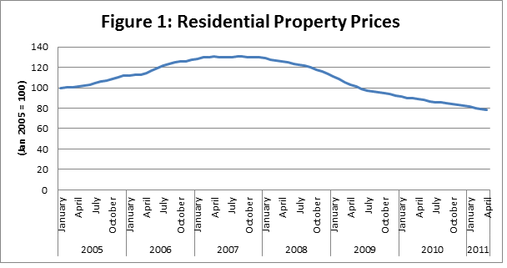

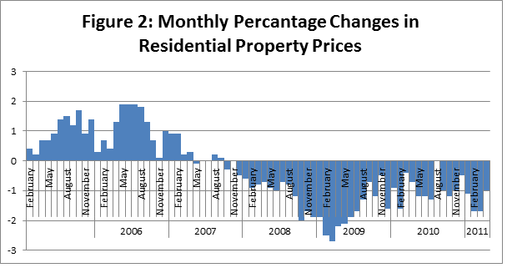

The latest figures from the CSO show that house prices have continued to fall in May 2011. So far, in the year to May, prices have fallen by 12.2%. In May itself, prices fell by 1.2%, up from a fall of 1% in April. House Prices in Dublin are almost 46% lower than at their highest level in early 2007. Apartments in Dublin are 53% lower than they were in February 2007.

0 Comments

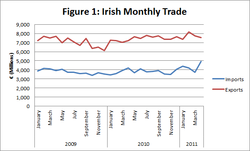

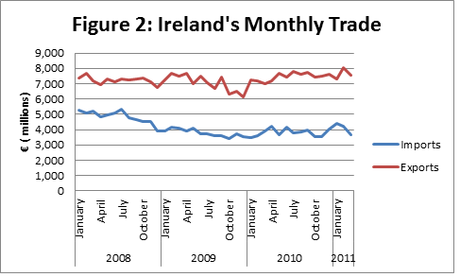

Seasonally adjusted imports have increased by 32% from €3,712m in March 2011 to €4,914m in April 2011. This is one of the largest increases in imports in recent months, as can be observed in Figure 1. However, during the same time exports have decreased by 2%, from €7,718m to €7,530m. This decline follows a similar decline for the period February to March. As the Irish economy recovery has been mainly driven by export growth, these declining export figures are a worrying sign for the national economy.

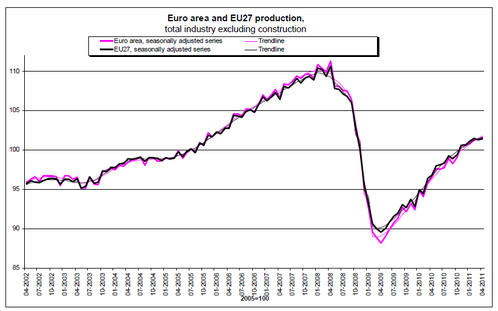

Following on from last week’s post about an increase in Ireland’s industrial output, the EU areas industrial as a whole has also risen, perhaps being a positive sign for economic recovery to some extent. Figure 1, taken from this Eurostat report, shows how, after substantial falls in 2008, industrial production is on the rise again. The graph excludes the construction industry. While figures for this industry are not available in the Eurostat report, it can be envisaged that had they been included the falloff in industrial production would have been substantially lower. The recent recovery in industrial output has allowed the EU area to rise back to a little over 2005 level output.

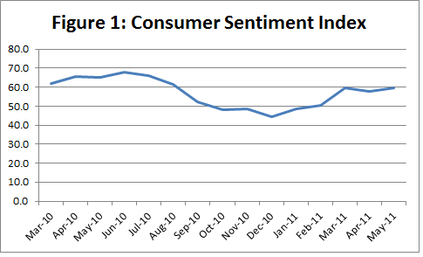

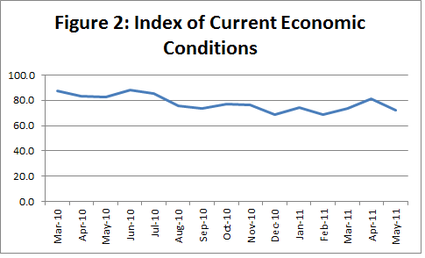

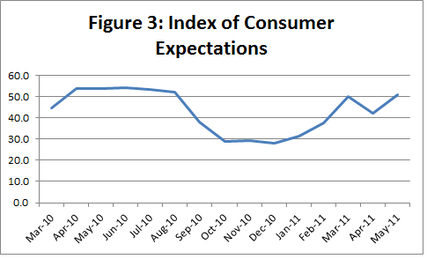

The month of May 2011 saw an increase in the consumer sentiment index operated by the ESRI and KBC Bank. It has increased from 57.9 in April to 59.4 in May. So far this year, apart from a dip in April, the consumer sentiment index has increased month on month from just 48.7 in January to 59.4 in May (it reached 59.5 in March but the fall in April reduced the index). This suggests that consumers are starting to form a more positive outlook, but it is still very low compared to even the figures observed at the start of 2010. The Consumer Sentiment Index is comprised of two sub-indices; an index of consumer expectation that focuses on how consumers view prospects over the next 12 months and an index of current economic conditions, focusing on the present situation. There has been a decline in how the current economic conditions were viewed, with this falling from a figure of 81 in April to 72.1 in May. But consumers are viewing the future prospects of the economy positively, being up from 42.3 in April to 50.8 in May.

The latest report from the CSO indicate that house prices have again fallen in April. Figure 1 shows the value of house prices using January 2005 as the base year. Figure 2 plots the rate of the decline. It can be seen that the rate of decline in house prices in 2011 so far is lower than that observed in 2009 but actually worse than that experienced in 2010.

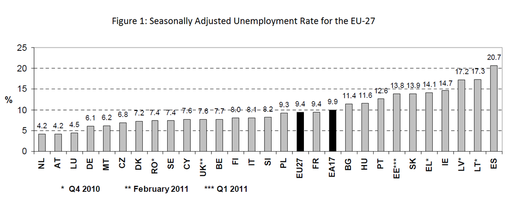

Following on from my post yesterday which showed Ireland’s unemployment rate had increased to 14.8% in May (which can be viewed here), a recent publication from Eurostat has shown that Ireland’s unemployment rate is the fourth highest in the EU. Figure 1 shows how Ireland is only behind Spain (which has an unemployment rate of 20%), Lithuania and Latvia (both of whom have unemployment rates of above 17%) in terms of the highest unemployment rate. This highlights the extent to which Ireland’s unemployment rate has climbed, from a mere 4% during the Celtic Tiger period.

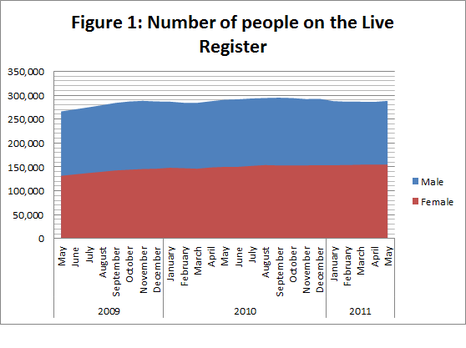

The standardised rate of unemployment has risen again in May 2011 to 14.8%, up from 14.7% in April 2011. This increase is up from an average unemployment rate in 2010 of 13.6%. An additional 2,600 individuals signed onto the live register in May (this figure is seasonally adjusted). Of these 2,600 individuals at total of 2,200 were male and only 400 were female. In total 100 men under the age of 25 actually signed off the live register in may while 100 women under the age of 25 signed on, meaning that there was no overall increase in the number of individuals under 25 signing on. However, an additional 2,300 men over the age of 25 signed on while only an additional 300 women over the age of 25 signed on.

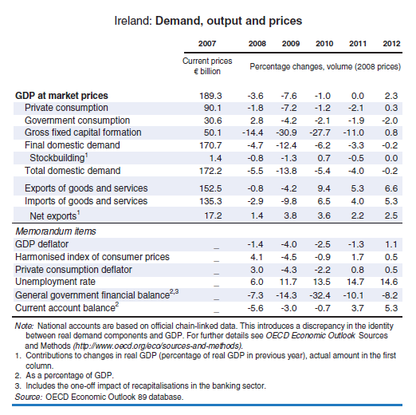

The OECD’s latest Economic Outlook on Ireland highlights the continuing problems associated with the Irish economy. They note that while exports have been preforming relatively well, the domestic economy is still in decline. Since 2007, GDO has fallen by over 14%. Government cuts are having a substantial impact on the contribution of both government spending and investment to GDP. Likewise domestic consumption has continued to decline with individuals choosing to save and pay down debt. All these factors contribute to the week domestic situation. Unemployment has risen towards the end of 2010 to approximately 14.7%. However, the outlook is not all bad as can be seen in Figure 1 below. Figure 1 is taken from the OECD’s economic outlook available here. We can see how declines in private consumption, government consumption and investment have all declined sharply over the course of the last three years. While exports, and recently imports, have bucked this trend. For 2011, the OECD is forecasting that Ireland will stagnate (i.e. have a growth of zero). They now expect a recovery not to occur until 2012, where they forecast GDP growth of 2.3%. This recovery they envisage being driven by strengthening private consumption and investment with exports continuing to grow.

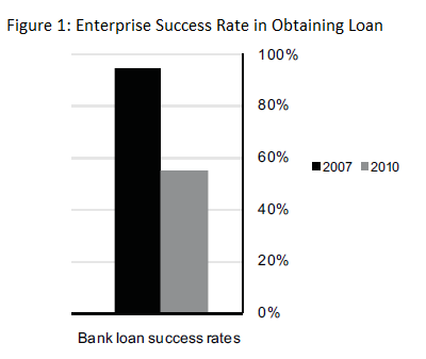

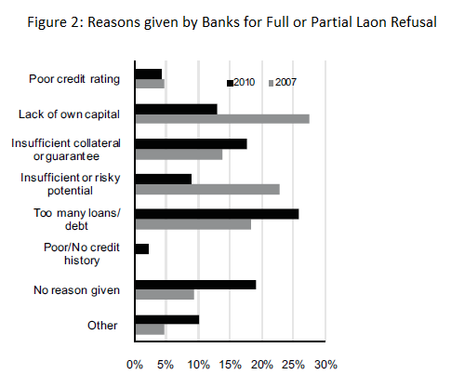

A lack of growth for 2011 if worrying from the Irish government’s perspective as positive growth in 2011 was forecast for bank stress tests and for the expectation of reducing the government deficit to 3% by 2015 at the latest. A recent survey by the CSO on the availability of credit for businesses has shown that the access to bank loans has fallen from 95% to 55%. This dramatic drop is highlighted in Figure 1. Figure 2 gives the results of why enterprises were refused loans. Surprisingly, the number of loans refused due to poor credit ratings are actually lower in 2010 than in 2007; likewise for lack of capital and insignificant or risky potential. However, the main reason for more refusals appears to be due to enterprises already possessing too many loans/debts. Also, there has been a dramatic increase in the number of cases which have been refused with no reason given for the refusal. These results appear to conform to what would be widely reported in the media; that access to capital from the banks has been reduced.

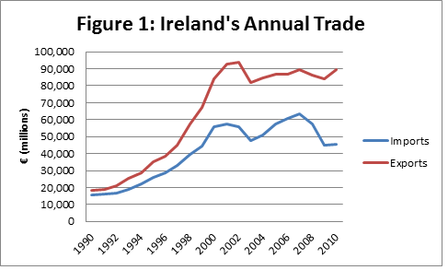

Ireland’s exports have decreased slightly in March 2011 compared to February, but the trade surplus has increased following a decline in imports. Figure 1 shows how Ireland’s trade surplus has been historically widening since the Celtic Tiger period of economic growth from the early 1990s onwards. This has continued to widen in 2011 as shown in Figure 2. The fall of 6% in monthly exports between February 2011 and March 2011 was offset by a fall in imports of 15% over the same time horizon. This resulted in a 3% increase in Ireland’s trade surplus in March 2011.

|

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed