|

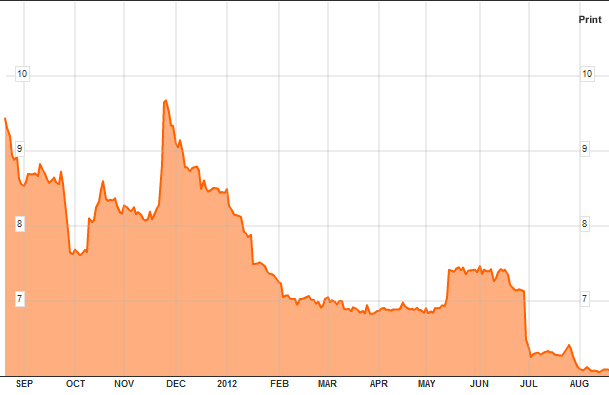

Ireland's 9 year bond yield has dropped below 6% for the first time since October 2010. Looking at the graph below we can see this is reflective of a generally downward trend over the past few weeks. Rates have fallen from a high of over 9.5% in December 2011 and while they rose slightly in June they have returned to their downward trend. This reduction in the cost of borrowing will be welcomed by Government as it is viewed as a measure of the credibility international investors view Ireland with. This follows the state raising €5 billion on the bond market last month.

410 Comments

I have just had an article published in the European Journal of Innovation Management. It can be accessed from here. The article poses the question that the introduction of numerous types of innovation simultaneously has a greater benefit for the firm that the introduction of these types of innovation in isolation. The abstract and title are below:

Are Differing Forms of Innovation Complements or Substitutes? Purpose – The purpose of this paper is to provide an empirical analysis of whether differing forms of innovation act as complements or substitutes in Irish firms’ production functions. Design/methodology/approach – The approach adopted by this paper is empirical in nature. Data are obtained for approximately 582 firms from the Irish Community Innovation Survey 2004-2006. In total, four forms of innovation activity are identified: new to firm product, new to market product, process and organisational innovation. Formal tests for complementarity and substitutability are applied to these types of innovation to assess whether they have a complementary effect on firms’ turnover. Findings – The results suggest that there is a substantial degree of complementarity among different forms of innovation. Out of six possible innovation combinations, three are complementary while none exhibits signs of substitutability. Social implications – From a business perspective, the importance of organisational change to facilitate technological innovation is highlighted, while from a policy perspective the importance of the incentivisation of organisation and process innovation is also highlighted. Originality/value – To date, most research has focused on the impact of various forms of innovation, in isolation, on firms’ productivity. They do not consider whether these forms of innovation may in fact be linked, and that by implementing two or more innovations simultaneously, the combined benefits may be greater than the sum of the parts. My latest article has just appeared in Entrepreneurship and Regional Development. It is a co-authored article with Dr. Eoin O'Leary and Dr. Declen Jordan (both also in the School of Economics in UCC). The article focuses on the impact of proximate and distant interaction on the likelihood of firms innovating while also taking account of the frequency with which firms interact. The article can be downloaded from here. The abstract is given below:

The effects of the frequency of spatially proximate and distant interaction on innovation by Irish SMEs Abstract: This paper tests whether more frequent interaction at different spatial levels has a positive effect on the innovation performance of small- and medium-sized enterprises (SMEs) in the South-West and South-East of Ireland. Based on an original survey, it finds that more frequent interaction generally increases innovation likelihood, but at a diminishing rate, thus suggesting a trade-off between resources dedicated to transforming knowledge into new products and processes. Spatially distant interaction is found to be at least as valuable as proximate interaction, which questions the received wisdom that the best sources of knowledge are regional. Given the value of distant interaction, the results indicate that regional lock-in may be an obstacle to superior innovation performance of SMEs. The Department of Public Expenditure and Reform has released its exchequer statement for the end of July 2012 (which can be found here). The highlights of the figures are that the tax take is ahead of target by approximately €500 million and are up on figures from last year. Three of which the Department refer to as the ‘big four’ taxes are ahead of predictions, with one falling below expected returns. Income tax is 2% ahead of prediction, VAT is 1.3% ahead and corporation tax is 18% ahead. Excise duty however is below expectations.

On the expenditure side current expenditure is also above what was planned by €317 million. This was attributed to overspending in Social Protection and Health groups. Overall, the exchequer reported a surplus in July on €317 million but to date this year is running at a deficit of €9,126 million. |

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed