On the expenditure side current expenditure is also above what was planned by €317 million. This was attributed to overspending in Social Protection and Health groups. Overall, the exchequer reported a surplus in July on €317 million but to date this year is running at a deficit of €9,126 million.

|

The Department of Public Expenditure and Reform has released its exchequer statement for the end of July 2012 (which can be found here). The highlights of the figures are that the tax take is ahead of target by approximately €500 million and are up on figures from last year. Three of which the Department refer to as the ‘big four’ taxes are ahead of predictions, with one falling below expected returns. Income tax is 2% ahead of prediction, VAT is 1.3% ahead and corporation tax is 18% ahead. Excise duty however is below expectations.

On the expenditure side current expenditure is also above what was planned by €317 million. This was attributed to overspending in Social Protection and Health groups. Overall, the exchequer reported a surplus in July on €317 million but to date this year is running at a deficit of €9,126 million.

5 Comments

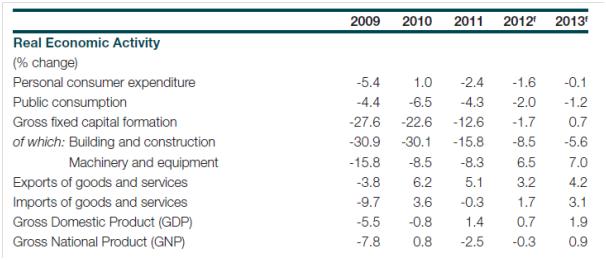

The Irish Central Bank has today released its Quarterly Bulletin on the Irish Economy. Below is a reproduction of the forecasted GDP growth table from this publication. What we can see is that Gross Domestic Product (GDP) is forecast to growth by 0.7% and 1.9% in 2012 and 2013. The forecast for 2012 is actually an upward revision of the Central Bank’s previous growth forecast of 0.5%. This upward revision reflects a better than expected domestic economic position. While the domestic position may be better than previously thought this does not mean that we have returned to an ideal situation. We can see that all aspects of the domestic economy (with the exception of gross fixed capital formation from machinery and equipment) is still declining. This contraction of the domestic economy has been occurring since the onset of the 2007 recession, with domestic personal consumption, public consumption and gross fixed capital formation. Exports remain the driving force of the Irish economy, increasing year on year. Without this growth in exports the Irish economy would still be contracting. The rise in GDP is also a reflection of the extent of foreign direct investment in the Irish economy. GNP essentially removes the profits of foreign companies operating in Ireland and includes the profits of Irish businesses operating elsewhere. This perhaps gives a more accurate reflection of the performance of the Irish economy. What we can see is that this is forecasted to continue to decline in 2012 (at a rate of -0.3%) but will return to growth in 2013 (at a rate of 0.9%).

Overall, while the Irish economy is forecasted to continue to grow in 2012 and 2013 this is forecasted mainly as a result of Ireland’s continued export growth and does not reflect growth in the domestic elements of GDP. Ireland issued its first new bonds since September 2010. They were offered to existing bondholders, who held government bonds which were due for payment. The new bonds are repayable in three years time. The total value of the issue was €3.5 billion at a rate of 5.2%. This is positive news for Ireland as it shows that investors are willing to hold Irish bonds. Ireland is the first of the three countries (Ireland, Greece and Portugal) to re-issue bonds with this level of maturity following IMF-EU bailouts.

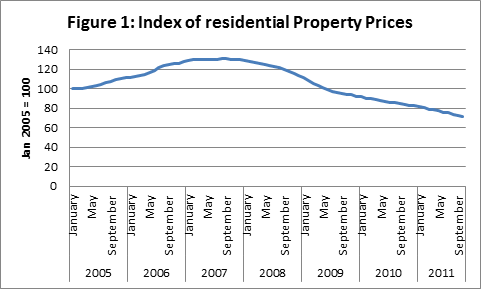

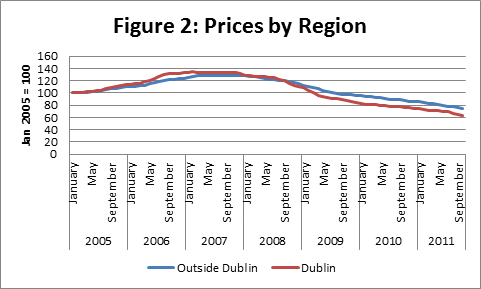

Residential property prices continue to fall with the latest figures from the CSO showing no sign of a slowdown in the decline. Figure 1 shows the continual decline in residential property prices from January 2005 to October 2011. When we break this down by region (the CSO only provides data on Dublin and Outside Dublin) we can see that residential prices in Dublin have declined more than those in the rest of the country. This may reflect an excess supply of these properties, constructed during the boom.

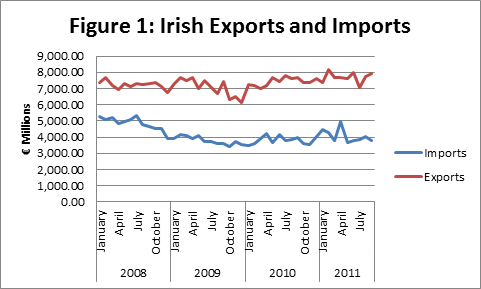

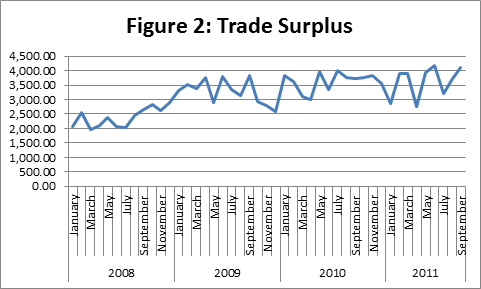

Seasonally adjusted exports increased by 2% in September while imports decreased by 5%. This can be observed in Figure 1, which shows Irish exports continuing to grow with a slight dip in imports in recent months. The fall in imports coupled with the increasing imports has resulted in a widening of the trade balance as shown in Figure 2.

The central bank has this week revised upwards its growth forecast for 2011. Previously, it had forecast that there would be practically no growth in the economy this year. However, the latest forecast expects GDP to grow by 1% for 2011. While not as high as could be hoped it is nevertheless positive growth at a time when Ireland needs some positive news. However, it should be noted that GDP is essentially made up of four components; trade, domestic consumption, investment and government expenditure.

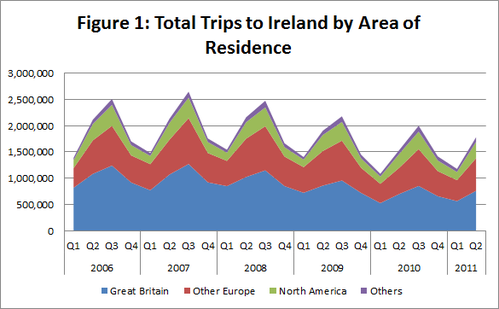

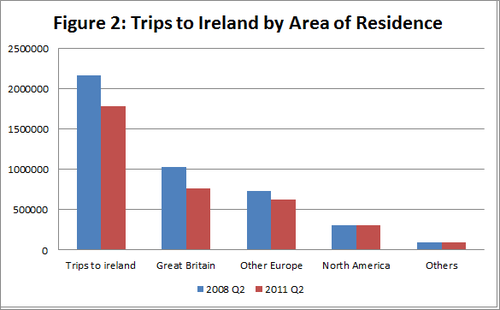

Looking closer at each of these components of GDP we can see that while the economy is forecast to grow at a rate of 1% this year, this growth is driven exclusively by export growth. Exports are expected to increase by 5.3% this year. This represents a substantial boost for Irish GDP. All of the Irish recovery to date has come from increased exports. These are made up of multinational companies in Ireland manufacturing goods here and selling them abroad and also the manufacture of goods by our own domestic companies and their foreign sales. Without this increased export activity Ireland would still be experiencing negative growth. When we look at the other factors of GDP, these are all still falling. Domestic consumption, which is basically what people are spending in the shops every day, is still falling as it has been for the last number of years. The continual decline in the amount individuals are consuming has a negative impact on the economy as less money is in circulation and changing hands. The reduction in consumption has resulted from people having less money to spend due to job losses and tax increases and people saving more in anticipation of further cuts to come. All of this has resulted in declining domestic consumption. Likewise, investment, which is made up of property purchases and firms buying new machinery, is also continuing to fall. While it is expected that firm investment will actually be positive in 2011, this is more than cancelled out by the continual decline in property investment. The rate of purchases of property has continued to fall throughout 2011 and represents a significant negative impact on the overall economy. The final element of GDP is government expenditure. Again this is falling, with lower levels of spending across most government departments. It is expected that this will fall by 3.8% this year, with further cuts next year. Overall, while the forecasted return to positive annual GDP growth in 2011 is good news, it should be borne in mind that of the four elements which drive growth, Ireland is solely reliant on exports at the moment for growth. Should the world economy deteriorate, our export markets may shrink and this would have negative implications for our continued recovery. The number of overseas visitors to Ireland has increased from last year. Tourist numbers have increased by a total of 15.5%. The number of visitors from Great Britain is up 8.5% while the number of tourists from the United States has increased by 16.9%. Visitor numbers from other European countries have risen by 24% and tourists from the rest of the world have increased by 21%. This is positive news for the tourism industry. However, while the figures are moving in the right direction, the numbers are still down compared to 2006, 2007 and 2008 levels. Figure 1 shows how the total number of visitors to Ireland has fallen over recent years and also shows the composition of the visitors to Ireland. While an improvement can be observed over last year, overall numbers are still down relative to the booming years of 2006-2008. Figure 2 shows this decline in more detail. It can be noted that while trips from North America and the rest of the world have recovered to pre-crash levels, visits from Great Britain, and Other European countries have failed to recover. As these two categories are the largest contributors to visits to Ireland this has a large negative impact on Ireland’s overall visitor numbers. In order to overcome the loss of tourists from Great Britain, the number of visitors from the US would have to approximately double or the number of visitors from the rest of the world would have to quadruple.

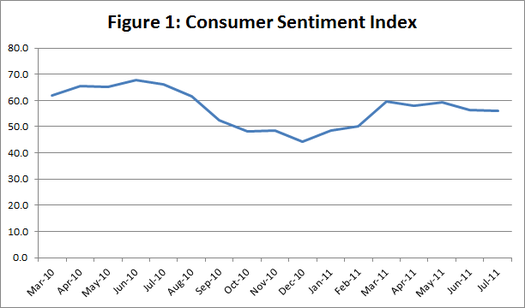

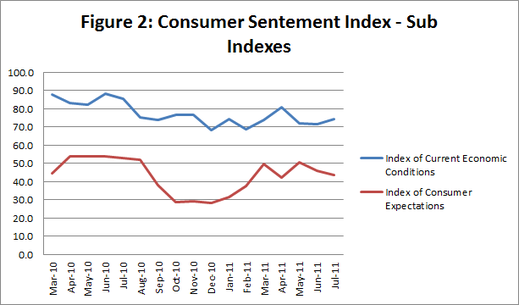

Figure 1 displays the ESRI’s consumer sentiment index for Ireland. While Irish consumer sentiment increased following the EU-IMF bailout over recent months it has been relatively stable. However, in July there was a slight drop in the index. It fell from 56.3 in June to 55.9 in July. Looking at the two sub-indexes which comprise the consumer sentiment index it is clear that this fall has been driven by consumer expectations. Consumers’ views of Ireland’s current economic conditions actually increased in July. Perhaps suggesting that Irish people are actually starting to perceive the current economic situation to be stabilising. However, consumers’ future expectations of the economy have decreased. This may be due to the recent news of more taxes (housing charge) and a hard budget to come in December. The falling outlook for future expectations is likely to translate into lower retail sales as consumers continue to save as oppose to consume.

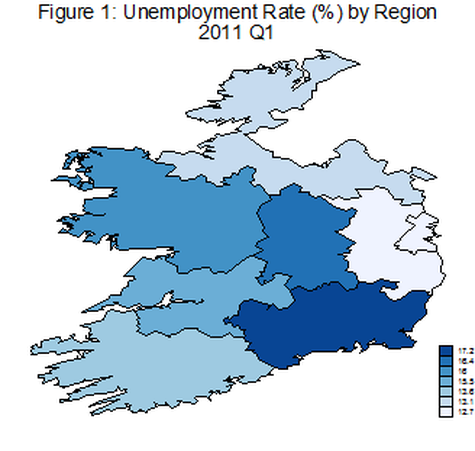

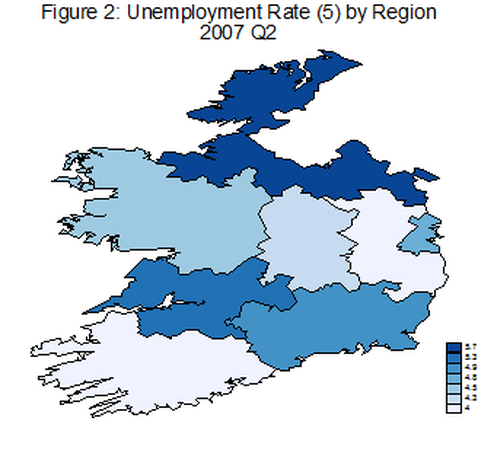

We are all aware of Ireland’s dramatically increasing unemployment rate, which has reached in excess of 14% recently and held constant. While the problems caused by this increase are being felt in every corner around Ireland, it is interesting to ask the question how equally this unemployment is distributed across Ireland. Figure 1 shows that the answer to this question is that different regions of Ireland have been impacted to a greater and lesser extent. However, when comparing Figure 1 to Figure 2, it is equally clear that all regions have been adversely affected since 2007. When comparing regions in 2011 it can be noted that unemployment in the South-East region is the highest in the country. The South-East consisting of Kilkenny, Wexford, Carlow and Waterford. These counties have been hit extremely hard by the recession. Taking Waterford as an example, the loss of the Waterford Crystal plant has had a substantial impact on the county.

It is clear from the figures that when considering how to tackle unemployment a one size fits all policy will not be sufficient. In terms of the unemployment rate the South-East may need more attention than other regions (such as the mid-East region) where unemployment is lower. I have just given an interview for UTV Radio. The interview was conducted by Stephanie Grogan. It was on the current bond market crisis Italy and Spain are facing. It will be broadcast on a number of local radio stations around the country. I outlined how Italy and Spain have gone above the threshold of 6% (which is considered the maximum sustainable rate) and how these are the highest bond rates either country has faced since joining the Eurozone. My view is that, while serious, the European Commission will act to help stabilise the issue. The long term implications are likely to be changes in the structure of the Eurozone and the Stability Fund proposed.

|

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed