|

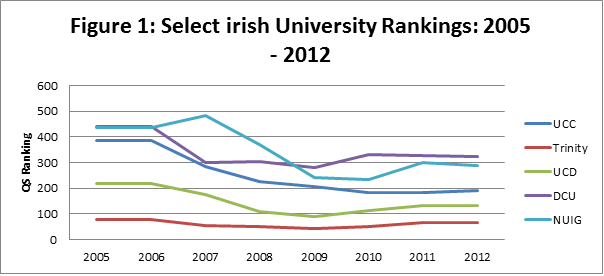

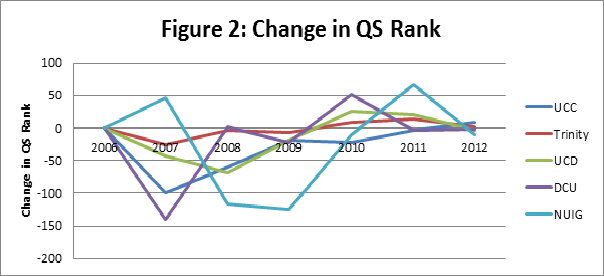

The latest QS University rankings have just been released. Irish Universities, for the most part, have continued their gradual fall in the rankings or maintained their ranking. The QS rankings are based on research, teaching, the employability of its graduates and international outlook. Figure 1 shows the actual rankings since 2005. The graph shows Irish universities have had a strong increase in rankings throughout this period but with a worsening outlook for 2011 and 2012. Figure 2 shows the rate of change over the same time period. During the 2005 to 2009 period all Irish universities were showing improving rankings. However, from 2010 onwards this situation has reversed and most Irish universities are now losing ground on their international competitors or making only marginal gains on them.

49 Comments

The latest Global Competitiveness Report has just been released and can be accessed here. Some interesting statistics on Ireland can be gained from the report.

Notably, Ireland has improved its competitiveness ranking from 29th (which it held for the last two years) to 27th. Increased competitiveness is views as enabling an economy to grow more rapidly (and in the case of Ireland may have implications for recovery). However, this ranking of 27th, while good, is comprised of some worrying outlooks on the Irish economy. For instance, Ireland's macroeconomic outlook is ranked as 131st. Indicating the high level of uncertainty regarding Ireland's growing debt and the ability of the Irish economy to recover following the recession. It also reflects Ireland's budget problems and high debt to GDP ratio. Ireland's Financial Market Development is ranked at 108, again indicating a high level of uncertainty regarding the financial institutions in place in Ireland. It also takes into account the difficulty of getting finance from various sources. Indeed, when asked the most problematic factor for doing business in Ireland business reported a lack of access to finance as their number one problem. So overall, while Ireland's competitive position has increased slightly from previous years, there is still a large amount of uncertainty surrounding the macroeconomic environment (government budgets, debt etc) and the financial system (access to finance etc). The Department of Public Expenditure and Reform has released its exchequer statement for the end of July 2012 (which can be found here). The highlights of the figures are that the tax take is ahead of target by approximately €500 million and are up on figures from last year. Three of which the Department refer to as the ‘big four’ taxes are ahead of predictions, with one falling below expected returns. Income tax is 2% ahead of prediction, VAT is 1.3% ahead and corporation tax is 18% ahead. Excise duty however is below expectations.

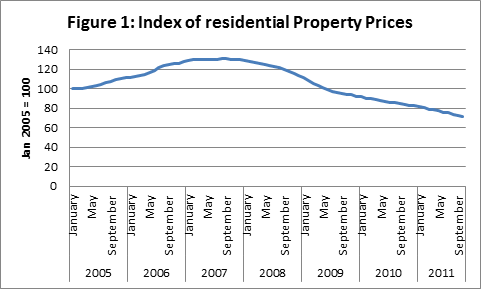

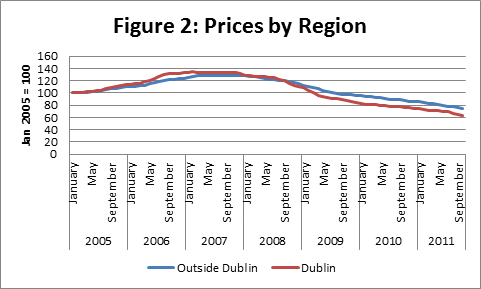

On the expenditure side current expenditure is also above what was planned by €317 million. This was attributed to overspending in Social Protection and Health groups. Overall, the exchequer reported a surplus in July on €317 million but to date this year is running at a deficit of €9,126 million. Residential property prices continue to fall with the latest figures from the CSO showing no sign of a slowdown in the decline. Figure 1 shows the continual decline in residential property prices from January 2005 to October 2011. When we break this down by region (the CSO only provides data on Dublin and Outside Dublin) we can see that residential prices in Dublin have declined more than those in the rest of the country. This may reflect an excess supply of these properties, constructed during the boom.

The BBC news website has an interesting interactive web application which allows users to quickly view which EU countries owe money to each other and to countries outside Europe. It provides a quick glance at the extent of the Irish debt crisis and the countries to which we owe money. The application is available here.

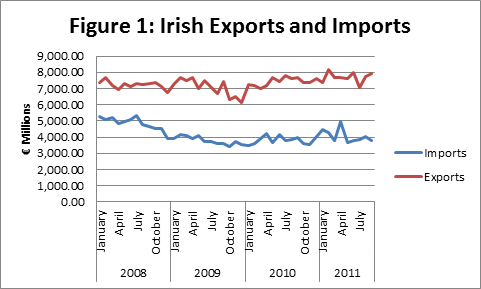

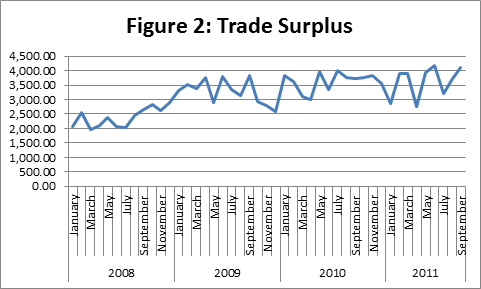

Seasonally adjusted exports increased by 2% in September while imports decreased by 5%. This can be observed in Figure 1, which shows Irish exports continuing to grow with a slight dip in imports in recent months. The fall in imports coupled with the increasing imports has resulted in a widening of the trade balance as shown in Figure 2.

A lot of attention has focused in recent days on the potential that mortgage forgiveness should be considered for home owners who are having difficulty in repaying their mortgages and are in negative equity. The recent focus on mortgage forgiveness has arisen from Professor Morgan Kelly’s keynote speech at the recent Irish Society of New Economists conference where he claimed that mortgage forgiveness is affordable and could help stimulate the domestic economy. Propositions have suggested those who cannot afford repayments should have the value of their debt written down or be allowed to walk away from their mortgages without any ramifications.

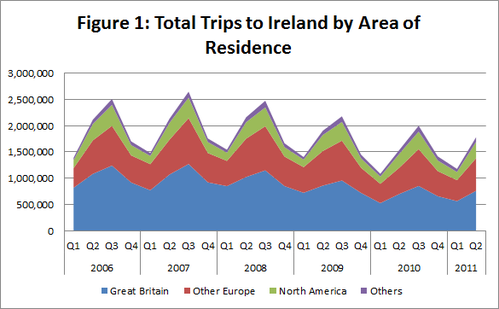

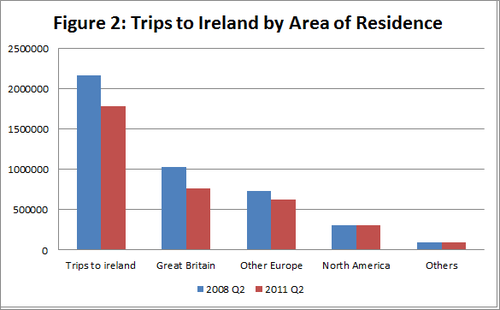

Proponents of mortgage forgiveness argue that through reducing the repayments individuals have to make on their mortgages they will have more disposable income to spend. They argue that this income will be spent in domestic shops thus stimulating employment and economic growth. While this may work well in theory, the practical elements of how mortgage forgiveness would work have not been addressed in great detail. There has been relatively little discussion as to how the scheme would actually work. For instance, forgiving debt does not make it disappear. Someone, somewhere will have to cover the losses which are suffered as a result of mortgages being written off. For Irish banks this will most likely be tax payers. While extra capital may not be required to allow these debts to be written off any depletion of banks capital will essentially be a transfer from the state to those in negative equity. As for non-Irish banks, government funding may have to be allocated to repay the losses they would suffer in forgiving debt. Following this is the problem of identifying who is classified as being able to meet their mortgage payments and those who are not able to make their repayments. While the Central Bank estimates that almost 50,000 mortgages are in arrears of three months there are a substantial number of households who are making severe sacrifices so as to cover their repayments. The introduction of mortgage forgiveness may act as a disincentive these individuals. Why struggle to repay your mortgage when you can potentially avail of a write down in your debt. The introduction of mortgage forgiveness could act to disincentive those struggling as it effectively punishes those who can afford to pay their mortgages. Then there is the issue of whether those who are granted debt forgiveness lose some of the equity of their house. Essentially meaning that if they choose to sell their house at a later date the bank, or government, obtain a proportion of the value of the sale proportional to the extent of forgiveness they received. Little attention has been paid to whether equity would be taken from houses which avail of debt forgiveness and what the optimal level of equity would actually be. This is likely to be a sensitive issue if implemented as it would require individuals to lose full ownership of their homes. Alternative mechanisms to debt forgiveness could provide a better solution. One such option is a form of interest holiday. This allows mortgage holders a period of time where they will be exempt from making interest repayments. They would instead concentrate on paying off the principle value of their mortgage. Alternatively, individuals may be facilitated in restructuring their mortgages over a longer time period allowing for a reduction in their monthly repayments. Both of these options result in the individuals having to repay the full extent of their mortgage. However, they appear to offer more realistic and better options than forgiving debt. The number of overseas visitors to Ireland has increased from last year. Tourist numbers have increased by a total of 15.5%. The number of visitors from Great Britain is up 8.5% while the number of tourists from the United States has increased by 16.9%. Visitor numbers from other European countries have risen by 24% and tourists from the rest of the world have increased by 21%. This is positive news for the tourism industry. However, while the figures are moving in the right direction, the numbers are still down compared to 2006, 2007 and 2008 levels. Figure 1 shows how the total number of visitors to Ireland has fallen over recent years and also shows the composition of the visitors to Ireland. While an improvement can be observed over last year, overall numbers are still down relative to the booming years of 2006-2008. Figure 2 shows this decline in more detail. It can be noted that while trips from North America and the rest of the world have recovered to pre-crash levels, visits from Great Britain, and Other European countries have failed to recover. As these two categories are the largest contributors to visits to Ireland this has a large negative impact on Ireland’s overall visitor numbers. In order to overcome the loss of tourists from Great Britain, the number of visitors from the US would have to approximately double or the number of visitors from the rest of the world would have to quadruple.

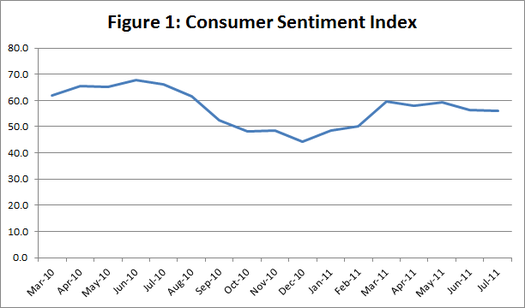

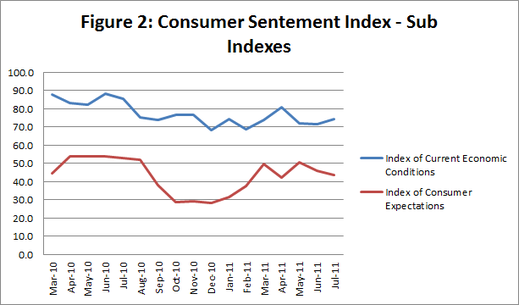

Figure 1 displays the ESRI’s consumer sentiment index for Ireland. While Irish consumer sentiment increased following the EU-IMF bailout over recent months it has been relatively stable. However, in July there was a slight drop in the index. It fell from 56.3 in June to 55.9 in July. Looking at the two sub-indexes which comprise the consumer sentiment index it is clear that this fall has been driven by consumer expectations. Consumers’ views of Ireland’s current economic conditions actually increased in July. Perhaps suggesting that Irish people are actually starting to perceive the current economic situation to be stabilising. However, consumers’ future expectations of the economy have decreased. This may be due to the recent news of more taxes (housing charge) and a hard budget to come in December. The falling outlook for future expectations is likely to translate into lower retail sales as consumers continue to save as oppose to consume.

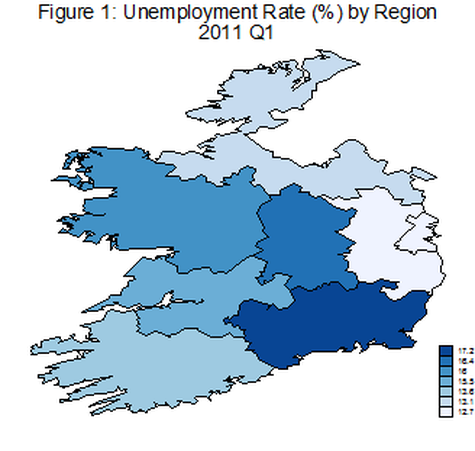

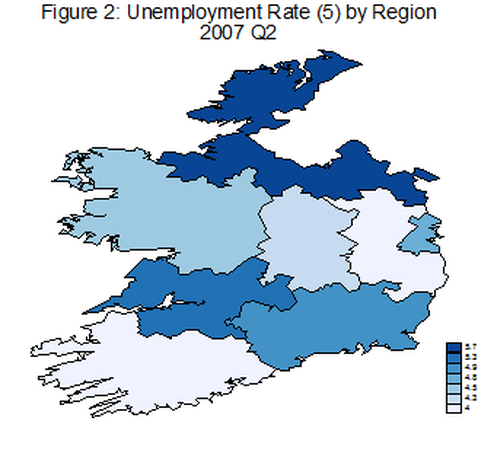

We are all aware of Ireland’s dramatically increasing unemployment rate, which has reached in excess of 14% recently and held constant. While the problems caused by this increase are being felt in every corner around Ireland, it is interesting to ask the question how equally this unemployment is distributed across Ireland. Figure 1 shows that the answer to this question is that different regions of Ireland have been impacted to a greater and lesser extent. However, when comparing Figure 1 to Figure 2, it is equally clear that all regions have been adversely affected since 2007. When comparing regions in 2011 it can be noted that unemployment in the South-East region is the highest in the country. The South-East consisting of Kilkenny, Wexford, Carlow and Waterford. These counties have been hit extremely hard by the recession. Taking Waterford as an example, the loss of the Waterford Crystal plant has had a substantial impact on the county.

It is clear from the figures that when considering how to tackle unemployment a one size fits all policy will not be sufficient. In terms of the unemployment rate the South-East may need more attention than other regions (such as the mid-East region) where unemployment is lower. |

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed