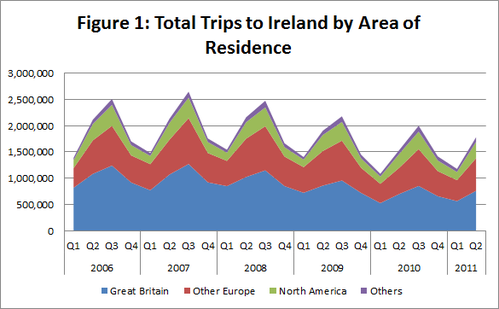

Figure 1 shows how the total number of visitors to Ireland has fallen over recent years and also shows the composition of the visitors to Ireland. While an improvement can be observed over last year, overall numbers are still down relative to the booming years of 2006-2008.

|

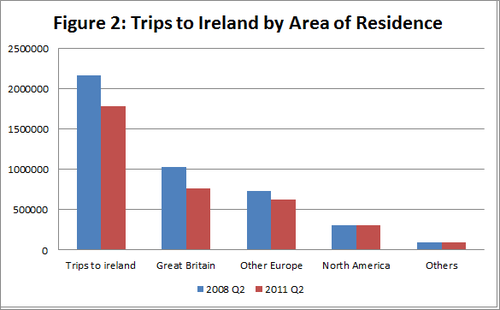

The number of overseas visitors to Ireland has increased from last year. Tourist numbers have increased by a total of 15.5%. The number of visitors from Great Britain is up 8.5% while the number of tourists from the United States has increased by 16.9%. Visitor numbers from other European countries have risen by 24% and tourists from the rest of the world have increased by 21%. This is positive news for the tourism industry. However, while the figures are moving in the right direction, the numbers are still down compared to 2006, 2007 and 2008 levels. Figure 1 shows how the total number of visitors to Ireland has fallen over recent years and also shows the composition of the visitors to Ireland. While an improvement can be observed over last year, overall numbers are still down relative to the booming years of 2006-2008. Figure 2 shows this decline in more detail. It can be noted that while trips from North America and the rest of the world have recovered to pre-crash levels, visits from Great Britain, and Other European countries have failed to recover. As these two categories are the largest contributors to visits to Ireland this has a large negative impact on Ireland’s overall visitor numbers. In order to overcome the loss of tourists from Great Britain, the number of visitors from the US would have to approximately double or the number of visitors from the rest of the world would have to quadruple.

3 Comments

This is a copy of the presentation I gave at this year's Irish Society of New Economists annual conference in UCD. The paper is co-authored with Robert Butler ( also of the Department of Economics UCC). The paper compares two competing growth models, New Economic Geography (NEG) theory and the Solow growth model. The results suggest that both can explain economic growth. Anyone interested in obtaining a copy of the working paper can contact me or Robbie. Doran and Butler (2011) ISNE Presentation View more presentations from doran_justin. I partook in an interview today with Seamus Martin on Tip Today on TipFM regarding Morgan Kelly's debt forgiveness proposal made at the Irish Society of New Economists annual conference. I discussed the problems associated with the introduction of a debt forgiveness programme and suggested that providing interest payment holidays may be a more appropriate solution to the problem.

I took part in an interview today with Stephanie Grogan on UTV radio on the German and French proposals for a more fiscally integrated eurozone. It can be listened to on various local radio stations including Cork 96 FM.

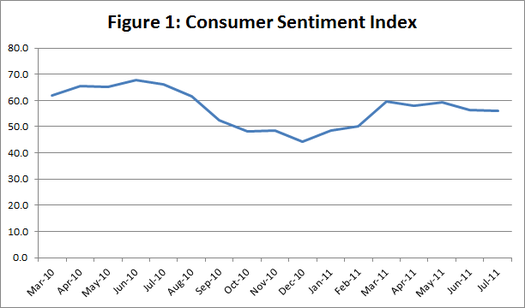

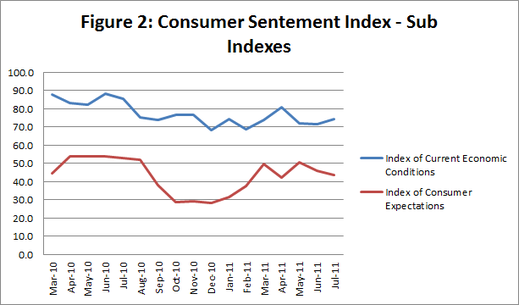

Figure 1 displays the ESRI’s consumer sentiment index for Ireland. While Irish consumer sentiment increased following the EU-IMF bailout over recent months it has been relatively stable. However, in July there was a slight drop in the index. It fell from 56.3 in June to 55.9 in July. Looking at the two sub-indexes which comprise the consumer sentiment index it is clear that this fall has been driven by consumer expectations. Consumers’ views of Ireland’s current economic conditions actually increased in July. Perhaps suggesting that Irish people are actually starting to perceive the current economic situation to be stabilising. However, consumers’ future expectations of the economy have decreased. This may be due to the recent news of more taxes (housing charge) and a hard budget to come in December. The falling outlook for future expectations is likely to translate into lower retail sales as consumers continue to save as oppose to consume.

I have an article today in the Irish sun on the current bond and stock market crises facing the eurozone.

I contributed to an article published in today's Evening Echo on the introduction of the €100 Household Charge. The discussion focused on the fact that while the charge is needed, the introduction of a flat rate is regressive. The proposed value based tax for 2013/2014 will be more progressive, taxing those with higher value properties more.

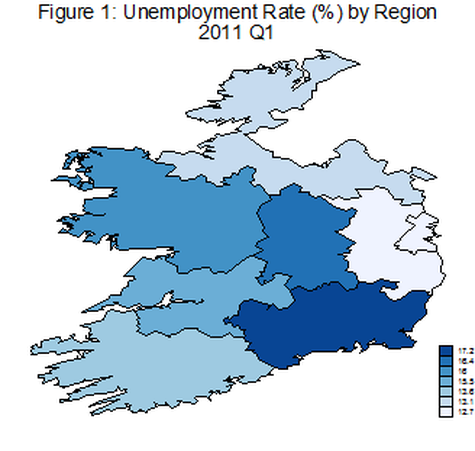

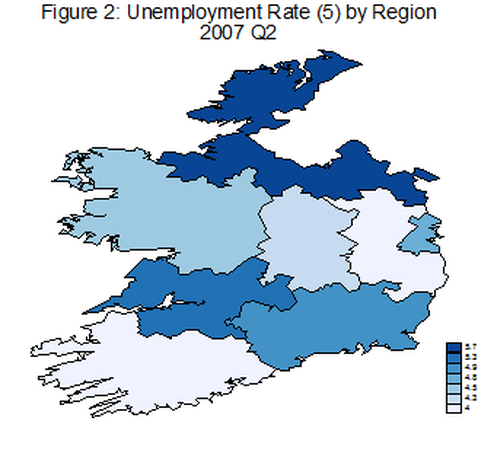

We are all aware of Ireland’s dramatically increasing unemployment rate, which has reached in excess of 14% recently and held constant. While the problems caused by this increase are being felt in every corner around Ireland, it is interesting to ask the question how equally this unemployment is distributed across Ireland. Figure 1 shows that the answer to this question is that different regions of Ireland have been impacted to a greater and lesser extent. However, when comparing Figure 1 to Figure 2, it is equally clear that all regions have been adversely affected since 2007. When comparing regions in 2011 it can be noted that unemployment in the South-East region is the highest in the country. The South-East consisting of Kilkenny, Wexford, Carlow and Waterford. These counties have been hit extremely hard by the recession. Taking Waterford as an example, the loss of the Waterford Crystal plant has had a substantial impact on the county.

It is clear from the figures that when considering how to tackle unemployment a one size fits all policy will not be sufficient. In terms of the unemployment rate the South-East may need more attention than other regions (such as the mid-East region) where unemployment is lower. I have just given an interview for UTV Radio. The interview was conducted by Stephanie Grogan. It was on the current bond market crisis Italy and Spain are facing. It will be broadcast on a number of local radio stations around the country. I outlined how Italy and Spain have gone above the threshold of 6% (which is considered the maximum sustainable rate) and how these are the highest bond rates either country has faced since joining the Eurozone. My view is that, while serious, the European Commission will act to help stabilise the issue. The long term implications are likely to be changes in the structure of the Eurozone and the Stability Fund proposed.

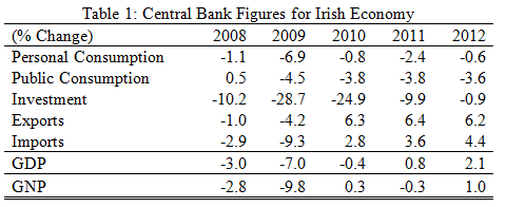

The Central bank released its quarterly report last week with its revised forecasts for 2011 and 2012. The outlook they predict is GDP growth of 0.6% in 2011 and 2.1% in 2012. This essentially translates into the first annual increase in economic output since 2007. Growth is good for the economy. It suggests more money will be available and that the government will have a higher tax take. However, when we take a closer look at the figures it can be noted that the sole factor driving economic growth in the forecasts is exports and to a lesser extent investment. Domestic consumption is forecast to contract further in 2011 and 2012. This essentially means that the central bank expects consumers to spend even less in 2012 than they are doing now. While export lead growth is important for a small open economy such as Ireland, a recovery in domestic consumption is to be hoped for. More domestic consumption further increases economic growth and can also generate employment.

However, the Central Bank forecasts that employment will only increase by 0.2% in 2012. This is much less than would be hoped for and will result in an unemployment rate of 13.9%, which is still incredibly high compared to a few years ago. The government’s strategy is to get more people back to work, and while the export sector will generate some employment, the sectors engaged in exporting are not necessarily labour intensive. Domestic consumption is required to generate local jobs around the country. This is the reason we are being encouraged by the government to spend more as oppose to saving. However, with increasing taxes and more uncertainty in the economy, it is unlikely that consumers will increase their spending. |

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed