|

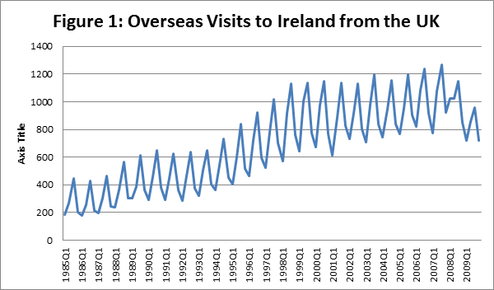

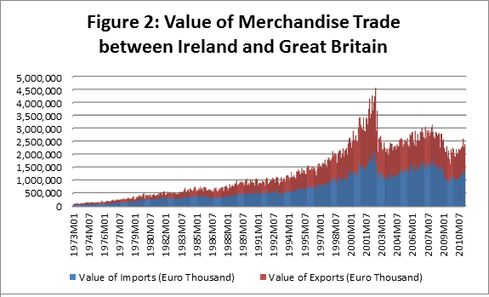

In light of the visit by the Queen to Ireland it is interesting to consider the interconnectedness of the Irish economy and the economy of the United Kingdom (UK). In terms of visits to Ireland by people from the UK we can see in Figure 1 that this has been increasing steadily from the mid-1980s (with the usual seasonal variation associated with tourism). However, must likely due to the recession this upward trend has been slightly abated since 2008. In terms of merchandise trade, Ireland is also becoming more interconnected with the UK (see Figure 2). Since the 1970s our trade with the UK has increased exponentially, peaking during the end of the 1990s at the height of the Celtic Tiger and declining slightly during the construction bubble phase of the economy. However, despite this decline in the latter part of the last decade, the UK remains Ireland’s largest export market. These two graphs are just an example of the interconnectedness of Ireland with our nearest neighbour and show how important the UK economy is for the Irish economy as a customer base for our tourism industry and also as a destination for our exports.

0 Comments

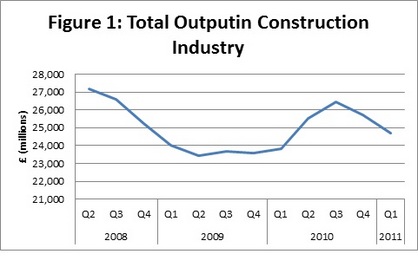

Ireland is not the only country experiencing a decline in the construction industry. The latest figures released by the Office of National Statistics in the UK suggest that in the first Quarter of 2011 construction output fell by 4%. This is somewhat expected given the typical seasonal deviations in the construction data. And the figure is less worrying when noting that output in Q1 2011 is 3.4% higher than output was in Q1 2010. Suggesting that there may be signs of a tentative recovery in output in the sector. However, it is still substantially below the levels observed at the height of the industry in 2007. Figure 1 shows how, over the last few years, construction output has declined dramatically but in recent quarters is displaying something of a recovery. This is dramatically at odds with what is occurring in Ireland where construction output has been in a continual downward spiral. It can be noted that while in 2009 output floundered throughout the year, following a continual decline in 2008, from Q1 2010 improvements were observable in the output of the industry. This peaked in Q2 and Q3, as would be expected given the highly seasonal nature of this industry. The decline in Q4 2010 and Q1 2011 are likely the result of this typical seasonal variation and when figures are released in three months time for Q2 2011, provided that there is no major shock to the industry, it would be expected that the output would rise again. It will be interesting to observe however whether the output rises above that experienced in 2010 or whether, year on year, the seasonal peaks will be lower.

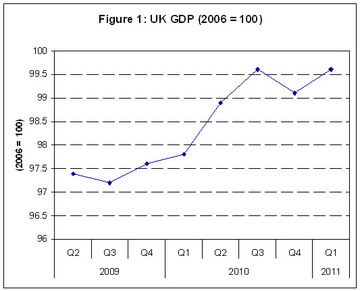

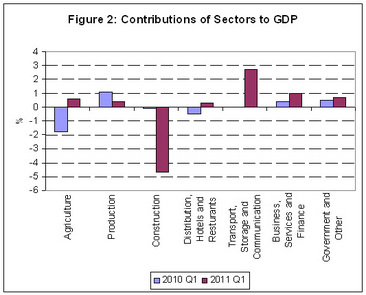

According to the UK Office of National Statistics in their latest update UK Gross Domestic Product (GDP) has increased by 0.5% in the first quarter of 2011. This increases makes up for a fall in GDP in the last quarter of 2010 (where GDP fell by 0.5%). This rebound can clearly be observed in Figure 1. However, as the growth in Q1 2011 has only made up for the ground lost in Q4 2010, this suggests that UK GDP has remained relatively unchanged since Q3 2010. This may suggest that any talk of rapid economic recovery in early 2010 may have been unfounded. With growth essentially being static from Q3 2010 onwards. When we break down the causes of Growth in Q1 2011 (comparing them to Q1 2010) in Figure 2, it can clearly be observed that the construction sector continues to decline rapidly. While Transport, Storage and Communications has moved from static growth in Q1 2010 to rapid growth in Q1 2011. Indeed it appears to be the services sectors which are driving growth with Business Services and Finance also growing rapidly. Agriculture and Production (manufacturing) are also growing. This general growth across the economy (with the notable negative construction effect) is encouraging. Growth appears to be arriving through a number of channels as oppose to being concentrated in any one particular of the economy suggesting that the growth achieved may be robust to any shocks in different sectors.

|

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed