|

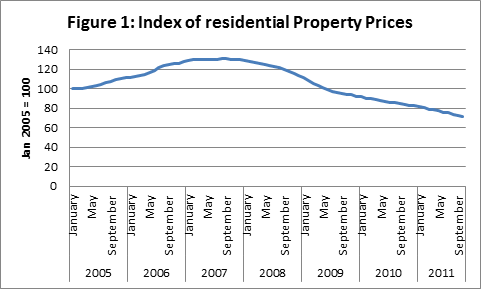

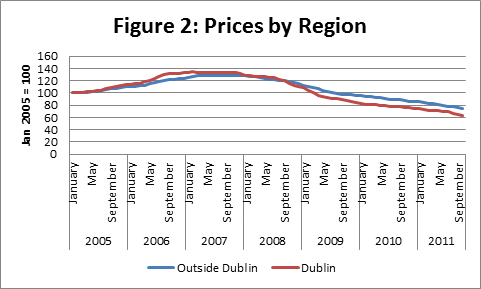

Residential property prices continue to fall with the latest figures from the CSO showing no sign of a slowdown in the decline. Figure 1 shows the continual decline in residential property prices from January 2005 to October 2011. When we break this down by region (the CSO only provides data on Dublin and Outside Dublin) we can see that residential prices in Dublin have declined more than those in the rest of the country. This may reflect an excess supply of these properties, constructed during the boom.

2 Comments

The BBC news website has an interesting interactive web application which allows users to quickly view which EU countries owe money to each other and to countries outside Europe. It provides a quick glance at the extent of the Irish debt crisis and the countries to which we owe money. The application is available here.

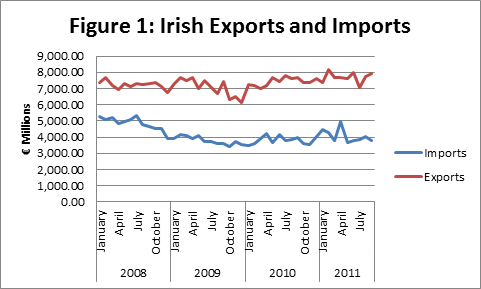

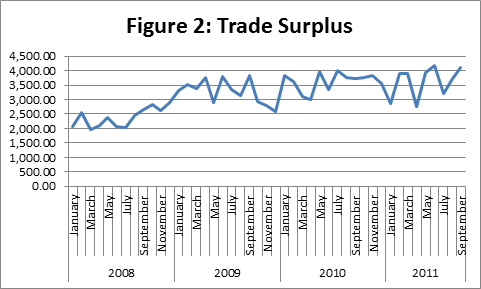

Seasonally adjusted exports increased by 2% in September while imports decreased by 5%. This can be observed in Figure 1, which shows Irish exports continuing to grow with a slight dip in imports in recent months. The fall in imports coupled with the increasing imports has resulted in a widening of the trade balance as shown in Figure 2.

I gave an interview today on UTV radio for various local radio stations. The interview covered the expansion of the EU bailout fund and the implications of the political uncertainty in Greece.

I took part in an interview today for UTV radio. It is featuring on a number of local radio stations. The discussion was on the repayment of the unsecured Anglo Irish Bank bonds.

I have given an interview for UTV radio (which will be aired on a number of local radio stations) regarding the potential "accounting error" which would see Ireland's government deficit being overstated by over €3 billion. It outlines the fact that if this is the case it is a once off payment and that at best it may allow the deferral of some cuts for a brief period of time. It also notes that we have other assets, such as the National pension Reserve Scheme which we are holding onto to and not cashing in fully on to meet our budget requirements.

|

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed