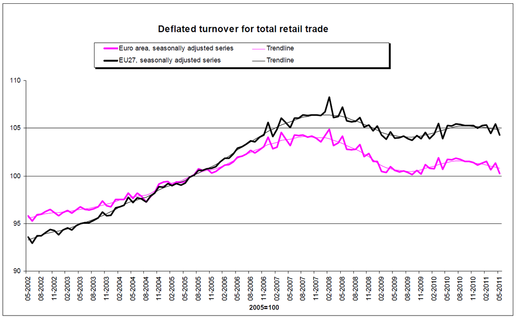

However, the Central Bank forecasts that employment will only increase by 0.2% in 2012. This is much less than would be hoped for and will result in an unemployment rate of 13.9%, which is still incredibly high compared to a few years ago.

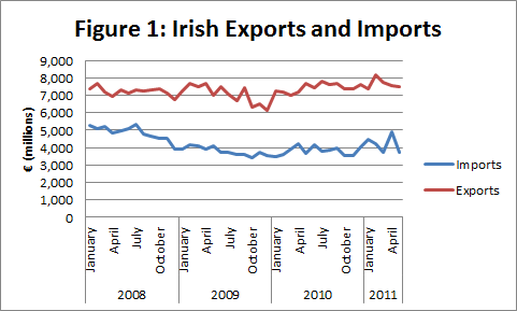

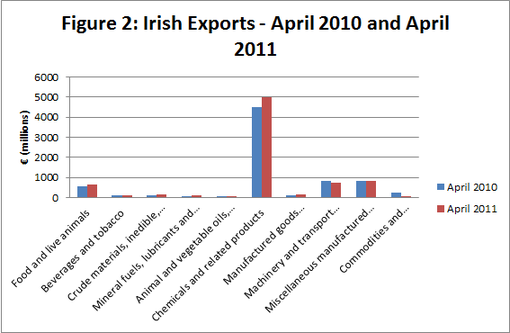

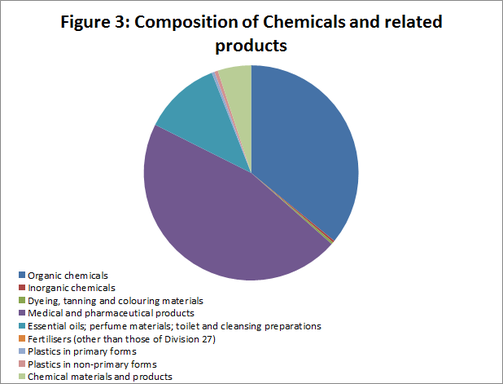

The government’s strategy is to get more people back to work, and while the export sector will generate some employment, the sectors engaged in exporting are not necessarily labour intensive. Domestic consumption is required to generate local jobs around the country. This is the reason we are being encouraged by the government to spend more as oppose to saving. However, with increasing taxes and more uncertainty in the economy, it is unlikely that consumers will increase their spending.

RSS Feed

RSS Feed