A lack of growth for 2011 if worrying from the Irish government’s perspective as positive growth in 2011 was forecast for bank stress tests and for the expectation of reducing the government deficit to 3% by 2015 at the latest.

|

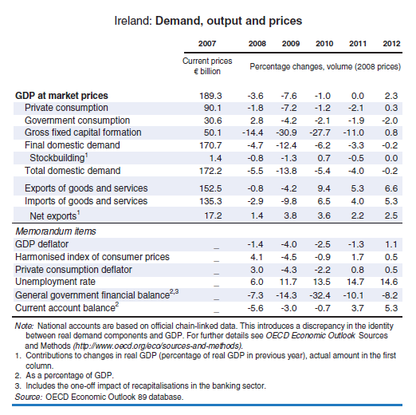

The OECD’s latest Economic Outlook on Ireland highlights the continuing problems associated with the Irish economy. They note that while exports have been preforming relatively well, the domestic economy is still in decline. Since 2007, GDO has fallen by over 14%. Government cuts are having a substantial impact on the contribution of both government spending and investment to GDP. Likewise domestic consumption has continued to decline with individuals choosing to save and pay down debt. All these factors contribute to the week domestic situation. Unemployment has risen towards the end of 2010 to approximately 14.7%. However, the outlook is not all bad as can be seen in Figure 1 below. Figure 1 is taken from the OECD’s economic outlook available here. We can see how declines in private consumption, government consumption and investment have all declined sharply over the course of the last three years. While exports, and recently imports, have bucked this trend. For 2011, the OECD is forecasting that Ireland will stagnate (i.e. have a growth of zero). They now expect a recovery not to occur until 2012, where they forecast GDP growth of 2.3%. This recovery they envisage being driven by strengthening private consumption and investment with exports continuing to grow.

A lack of growth for 2011 if worrying from the Irish government’s perspective as positive growth in 2011 was forecast for bank stress tests and for the expectation of reducing the government deficit to 3% by 2015 at the latest.

1 Comment

Leave a Reply. |

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed