|

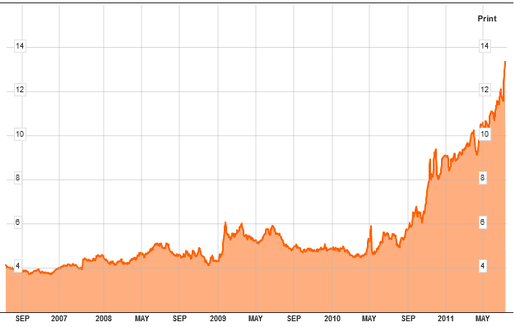

Ratings agency Moody's has downgraded Irish debt to "junk" status. What does this mean? Effectively it means that the rating agency believes that Ireland will default on its debt. Basically, not paying back money to individuals who had taken out government bonds. As is predictable with a down grade the yields on Irish government bonds rose dramatically, reflecting this increase in the perceived risk of Irish bonds. Below is a graph taken from Bloomberg which shows the yield on Irish 10 year government bonds. We can see the yield approaching 14% in recent days, with a large spike on the day of the announcement by Moody's. This announcement has been widely condemned by the EU, but from an Irish perspective it may place more pressure on the EU to provide additional funding and attention to Ireland over the coming weeks and months. It makes it practically impossible for Ireland to return to the bond market due to the very high yield that would be required to entice investors to hold Irish bonds.

0 Comments

Leave a Reply. |

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed