|

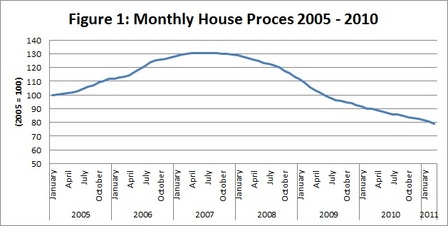

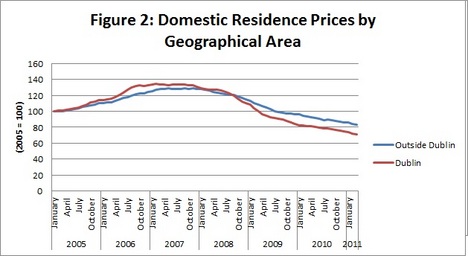

The latest index of house prices released by the CSO shows that house prices have continued to fall up to the end of March 2011. This decline has shown no slowdown with prices falling by an average of between 1% and 2% a month from their January 2005 price. While someone who purchased their house in January 2005 could have sold it at the height of the boom for an average price increase of 30.5%, the property is now worth an average of 21% less than the 2005 price paid. This is highlighted in Figure 1 below. Interestingly, when you look at Dublin versus the rest of Ireland it is possible to see that while prices rose faster and higher in Dublin prior to 2007, post recession prices have fallen faster and lower than the rest of Ireland. This may be due to the excessive development of apartment complexes in the Dublin area during the construction bubble, providing a large degree of excess supply which would have to be absorbed before prices begin to rise again.

0 Comments

Leave a Reply. |

AuthorJustin Doran is a Lecturer in Economics, in the Department of Economics, University College Cork, Ireland. Archives

December 2017

Categories

All

|

RSS Feed

RSS Feed