The Open Economy: An Introduction

An important feature of economies around the world is their degree of openness. The degree of openness of a country can be measured as the value of the transactions a country engages in with the rest of the world as a percentage of GDP. That is to say Exports and Imports as a percentage of GDP. Most economies across the world are open:

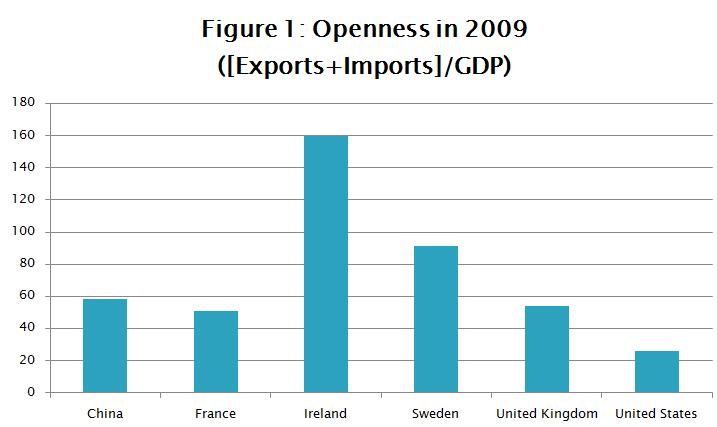

Figure 1 gives a sense of the openness of a number of countries.

- They export goods and services abroad.

- They import goods and services from abroad.

- They borrow and lend money in the world’s financial markets.

Figure 1 gives a sense of the openness of a number of countries.

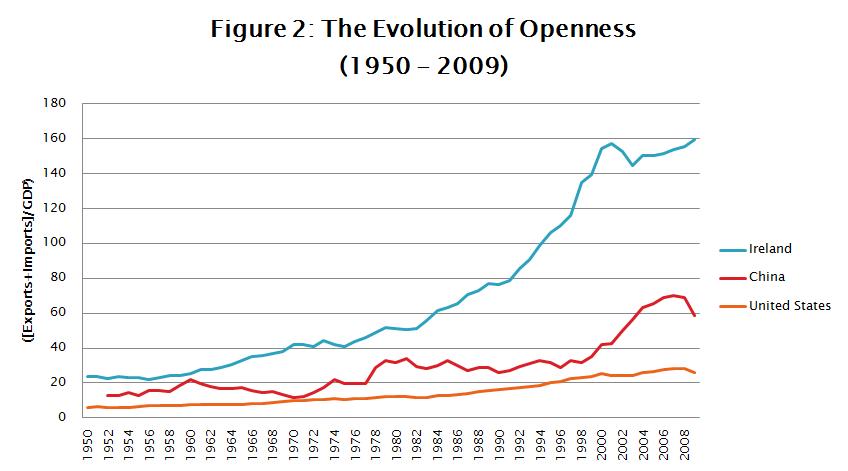

It can be observed from Figure 1 that Ireland is an incredibly open economy compared to other world economies. Figure 2 shows how Ireland has transformed from a relatively inward looking economy in the 1950s to one which has embraced international trade. Goods such as bananas and cars are traded internationally. While money deposited in Irish banks may be lent to businesses and individuals around the world.

The key macroeconomic difference between open and closed economies is that, in an open economy, a country’s spending in a given year need not equal its output of goods and services. A country can spend more than it produces by borrowing from abroad, or it can spend less than it produces and lend the difference to foreigners. To investigate this we will look at national income accounting.

Consider the expenditure on an economy’s output of goods and services. In a closed economy, all output is sold domestically. Domestic expenditure is divided into three categories.

This can be represented as:

Y = Cd + Id + Gd

In an open economy, some output is sold domestically and some is exported to be sold abroad. We can therefore include an Export component (EX) into the previous identity to create an open economy identity.

Y = Cd + Id + Gd + EX

The sum of the first three terms gives domestic spending on goods and services. The term EX is foreign spending on domestic goods and services. A bit of manipulation can make this identity more useful. Note that domestic spending on all goods and services equals domestic spending on domestic goods and services and domestic spending on foreign goods and services. Hence total consumption (C) is comprised of consumption of domestic goods and services Cd plus consumption of foreign goods and services Cf. The same applies for expenditure on total investment I which is made up of domestic investment Id and foreign investment If. Also total expenditure by government G is made up of domestic purchases Gd and foreign purchases Gf.

Therefore we have

C = Cd + Cf

I = Id + If

G = Gd + Gf

We substitute these into our identity for output and we get:

Y = (C - Cf) + (I - If) + (G - Gf) + EX

We can rearrange these to give

Y = C + I + G + EX – (Cf + If + Gf)

Where the sum of domestic spending on foreign goods and services is given as (Cf + If + Gf). This is expenditure on Imports (IM)

Thus we can write our identity as

Y = C + I + G + EX – IM

We can define net exports as Exports (EX) minus Imports (IM) which gives us NX. This allows us to rewrite our final identity as:

Y = C + I + G + NX

The key macroeconomic difference between open and closed economies is that, in an open economy, a country’s spending in a given year need not equal its output of goods and services. A country can spend more than it produces by borrowing from abroad, or it can spend less than it produces and lend the difference to foreigners. To investigate this we will look at national income accounting.

Consider the expenditure on an economy’s output of goods and services. In a closed economy, all output is sold domestically. Domestic expenditure is divided into three categories.

- Consumption (Cd)

- Investment (Id)

- Government Expenditure (Gd)

This can be represented as:

Y = Cd + Id + Gd

In an open economy, some output is sold domestically and some is exported to be sold abroad. We can therefore include an Export component (EX) into the previous identity to create an open economy identity.

Y = Cd + Id + Gd + EX

The sum of the first three terms gives domestic spending on goods and services. The term EX is foreign spending on domestic goods and services. A bit of manipulation can make this identity more useful. Note that domestic spending on all goods and services equals domestic spending on domestic goods and services and domestic spending on foreign goods and services. Hence total consumption (C) is comprised of consumption of domestic goods and services Cd plus consumption of foreign goods and services Cf. The same applies for expenditure on total investment I which is made up of domestic investment Id and foreign investment If. Also total expenditure by government G is made up of domestic purchases Gd and foreign purchases Gf.

Therefore we have

C = Cd + Cf

I = Id + If

G = Gd + Gf

We substitute these into our identity for output and we get:

Y = (C - Cf) + (I - If) + (G - Gf) + EX

We can rearrange these to give

Y = C + I + G + EX – (Cf + If + Gf)

Where the sum of domestic spending on foreign goods and services is given as (Cf + If + Gf). This is expenditure on Imports (IM)

Thus we can write our identity as

Y = C + I + G + EX – IM

We can define net exports as Exports (EX) minus Imports (IM) which gives us NX. This allows us to rewrite our final identity as:

Y = C + I + G + NX